The accounts for Birmingham City Football Club plc can be viewed on the Companies House website at this link.

As always, I must remind people that I am not an accountant and that I have had no training in financial matters.

The headline figures of the accounts make for somewhat grim reading, although they’re slightly better than I was expecting.

The accounts confirm that Blues made a £23.823M loss from operations for the season ending June 2022.

This may seem like a huge difference to the previous year when the club only lost £4.482M, but that previous loss was massively helped by the sale of Jude Bellingham to Borussia Dortmund.

This year’s accounts also confirm total revenues of £17.55m, which is up £4m on the previous year. This is mainly thanks to the end of Covid restrictions in the UK.

However, the revenues in the 21/22 season accounts are nearly 24% lower on the last set of club accounts prior to Covid.

I think this is attributable to the drop in average attendance from 22,483 to 16,152; something which is almost certainly down to the closed parts of the Tilton and Kop stands.

The other headline figure is wages, which is the first thing I want to discuss in greater detail.

The BCFC Wage Bill problem

Probably the most problematic figure for Blues within these accounts is the wage bill.

Staff costs for the season ending June 2022 were £31.112M, a slight increase on the previous year.

This gives a staff costs to turnover ratio of 177.28%.

In simpler terms, that means for every pound of income brought into the club, it paid out £1.77.

This should lay bare the problems the club has because there is no way it can come close to making a profit without trimming the wage bill heavily.

It is worth noting that not all of that £31.112M comes down to player wages, although they will make up the bulk of it.

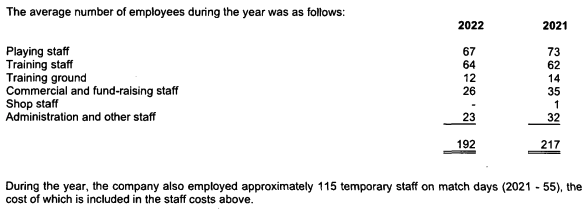

Section four of the accounts on pages 21/22 break down the staff costs a bit to help us understand the figures better.

That £31.112M pays for a playing staff of 67 players. This will include first teamers, under 21s and players on first and second year scholarships.

There are also 64 people on the training staff, again including coaches and staff working with the Academy, as well as a further 12 people working at the training ground and 26 commercial staff and 23 administrative staff.

While there is 115 temporary staff employed on match days, there are no staff employed by the club within the club shop as it is currently oursourced.

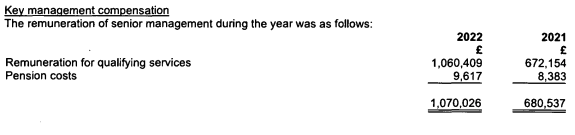

The accounts also confirm that just over £1m is paid to “Key Management Staff”.

Unfortunately, there is no specification as to who these staff are, or to how many of them there are.

There are nine members of the “Senior Management Team” listed on the official club website, including people such as MD Ian Dutton, Technical Director Craig Gardner, and Head Coach John Eustace along with senior members of the administrative staff.

If that £1m is split between those nine people then it would seem to me to be more than reasonable, but without confirmation of how many people it’s split between we are speculating.

The accounts also tell us that £456,203 was paid to club directors in the past year, with the highest paid director getting £177,974.

This is interesting for two reasons.

Firstly, the highest paid director fee has dropped by half since last year, when they received £365,966.

The fact that this corresponds with the departure of former CEO Ren Xuandong might be coincidental, but I suspect it isn’t.

Secondly, because the highest paid director gets paid less than half the total amount, we know mathematically at least three directors are getting paid by the club.

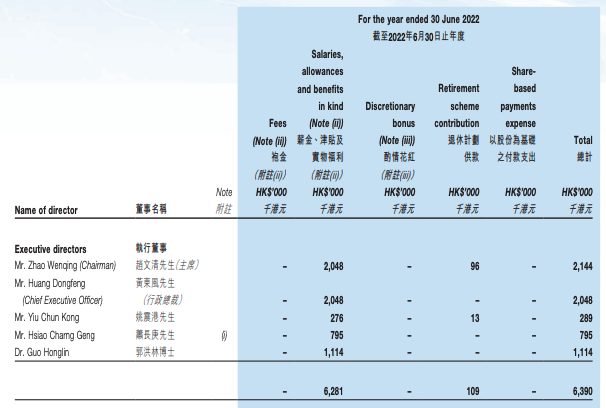

This is interesting because two of the directors of the club, namely Frank Zhao Wenqing and Jerry Yiu Chun Kong are both also directors of Birmingham Sports Holdings and got paid by that company as well.

Note 15 of the BSH Annual Report (on page 117) confirms that these directors got paid HK$2.048M and HK$276K (£213K and £28.7K) respectively by BSH.

As Zhao lives in Sutton Coldfield I’m naturally curious as to whether he got paid by BCFC and BSH; particularly as the accounts no longer note that director remuneration is recharged to Birmingham Sports Holdings.

The Debt Question

We’ve known for some time that the club is in a lot of debt to its owners, but in the past couple of years there has been some confusion as to exactly how much it is.

This is because in August 2021, it appeared that the owners had written off a huge amount of debt.

The way that they did this was to create new shares in Birmingham City Football Club plc.

As the owners already owned 100% of this business, creating these new shares as payment for debt was literally writing off debt – and with over 117,000,000 shares created, over £58M of debt was written off.

However, this is where it gets complicated to the point where I can’t understand it.

To explain it, we need to understand how the club is owned.

The club (Birmingham City Football Club plc) is owned by another company based in England and Wales called Birmingham City plc.

This second company was the holding company that David Sullivan and the Gold Brothers used to own the club, and is the company that people who still hold shares in the club have shares in.

It’s also the company that would be bought by people looking to buy the club such as Often Partisan Limited.

Almost all of Birmingham City plc is owned by two companies – Birmingham Sports Holdings (75%) and Oriental Rainbow Investments (21.64%).

When the club accounts came out, the accounts for Birmingham City plc were released at the same time.

The club accounts say that the Birmingham City Football Club plc owe Birmingham City plc £58m, which is a massive reduction on what it was.

However, the Birmingham City plc accounts confirm that company still owes BSH £90.9M and ORI a further £25.9M, which is a total of £116.8M.

I’ll admit it, but now I’m confused as to why the share issue took place in August 2021 if no actual debt was written off by the owners.

My only thought is that it was done to make things more palatable for the EFL.

If there is another reason I have missed I’ll happily be corrected and add it into this article.

The Maxco Issue

I’ve stated many times on this website how Maxco Capital helped to fund the club in the period between August and November 2022.

Because this period is after the accounts end date, there is no entries into the accounts themselves as to how this money came into the club.

However, there is a section dealing with matters after the balance sheet date which does confirm that Maxco put money in.

The accounts confirm that during negotiations:

“…working capital of £7,970,000 was provided to the club by Maxco Capital Co Ltd as part of the Master Sale and Purchase Agreement relating to the sale of Oriental Rainbow Investments Limited (ORIL) by its beneficial owners.”

This language is very specific which leads me to a couple of conclusions.

The first thing I noted is the words “was provided to the club by Maxco”.

These words are interesting because I would have expected this money was loaned to the club on the proviso that the deal would go through.

However, using the wording as they have in the accounts it would appear that in the eyes of the club (or the people who own it), there is an assumption this money was given to the club and does not need to be returned to Maxco.

If my conclusions are true, then one would assume there could be further legal implications as Maxco try to claw that money back.

I would also note that this is not proof that Maxco had “control” of the club as the EFL have alleged in their charges.

Third parties can and do lend money to clubs for working capital without issue under EFL regulations; the issue with the charges is that the EFL have alleged Maxco were making decisions about running the club without having first taken the Owners and Directors Test.

The other interesting thing I noted in that the wording is that it confirms that it was Oriental Rainbow Investments for sale rather than the stake in the club that company owns.

This is interesting to me because as ORI is a British Virgin Island company, any transfer of ownership would be much more opaque than buying the stake in the club itself.

I’d be interested to know if Often Partisan Limited are using the same mechanism – and if they are if they intend to retain ownership via the BVI in the long term should they be successful.

While these accounts do make for some grim reading, it’s worth noting that they’re not unusual in the Championship.

I’ve not yet done a side by side review of accounts released by clubs but from the bits I’ve read I think most Championship clubs run at a heavy loss and I would not be overly surprised if our wage to turnover ratio is fairly typical.

What these accounts show me is that any new owners have their work cut out to make the club sustainable, let alone profitable.

While player wages do need to continue to be brought down, for me the big thing the club needs to do is to bring revenue back up to pre-Covid levels.

This means getting the stadium sorted as quickly as possible to be able to sell more tickets.

More importantly it means the club need to provide people with a reason to want to buy tickets.

That means any new owners who may come in need to instil hope in the club once again, something which right now isn’t the easiest of tasks.