The announcement can be viewed at this link.

Before I go any further, I want to caveat this by confirming that I’m not a lawyer nor an accountant and nothing that I write here should be considered investment advice.

I’ve written this based on my lay knowledge and a couple of conversations I’ve had with people who know better.

I know that I make that caveat every time, but this time it’s important because this announcement is a beast.

Stretching to 37 pages of legalese jargon, this announcement is not for the faint hearted and it has taken me literally hours of re-reading to get to a point where I’m comfortable with sharing my thoughts.

This is a good thing, because it should demonstrate the level of legal help Tom Wagner, Jeremy Dale and their team have used to create this deal.

Make no mistake; this deal is far removed from the one that Maxco tried to put together last year. Yet unlike that deal, this one has been agreed with both Oriental Rainbow Investments and Birmingham Sports Holdings despite being significantly more buyer-friendly.

There is a lot to take in from this announcement, which has led me to make the decision to pick out the pertinent important points for us as Blues fans rather than go through it all.

The Headlines

This deal relates to the purchase of three things by Shelby Companies Limited:

- The 21.64% stake in Birmingham City plc currently owned by Oriental Rainbow Investments

- A 24% stake in Birmingham City plc currently owned by Birmingham Sports Holdings

- The entire 100% stake in Birmingham City Stadium Ltd currently owned by Oriental Rainbow Investments (25%) and Achiever Global Group Limited (75%).

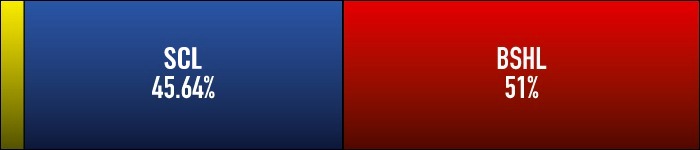

Once the deal is completed, the ownership of the club will be as pictured above, while St Andrew’s will be entirely owned by Shelby Companies Limited.

As per the announcement, there are four conditions precedent that have to be fulfilled before the deal can be completed:

- EFL approval of the deal

- Approval of the deal by independent shareholders in Birmingham Sports Holdings Ltd

- No termination of the agreement by either the buyer or the sellers

- No materially adverse change having occurred

In addition to this, the deal is either for all three parts listed above or none of it. This means that shareholder approval is required even for the bits that BSH do not own.

As part of the deal, both Trillion Trophy Asia and Dragon Villa have both delivered an Irrevocable Undertaking that they will both accept and vote the resolutions when the Extraordinary General Meeting is held to obtain shareholder approval.

This means that the shareholder approval is nothing more than a rubber stamp affair.

As Vong Pech cannot vote with his BSH shares at the EGM due to his material interest in the deal, forcing both TTA and Dragon Villa to confirm their approval beforehand makes it mathematically impossible for the resolutions to be defeated.

There is also a Long Stop Date for the deal of December 31, 2023.

What that means is if the conditions aren’t all fulfilled by then, the deal is off.

If the reason the deal has failed is because the EFL has not approved it, then neither side will be penalised financially for the deal failing.

While I can already see some of the more panicky members of the Blues fanbase thinking that the EFL will scupper this deal for us, that feeling is nothing more than paranoia.

It’s my opinion that the EFL need this deal to go through, and that they won’t do anything to prevent it. The situation at Blues is an embarrassment to the EFL and when this deal goes through it will help that embarrasment to go away.

That means the only obstacle to this deal being completed I can see is the one that isn’t listed in the announcement, which is HKSE approval.

The period between now and the EGM being announced is the timeframe which the HKSE has to decide if they are happy with the deal or not, and as it stands I think it should be okay. However if they have questions the date of the EGM can be pushed back.

Funding the club

One of the things I’ve already seen floating around on social media is the details of the “Operating Loan Agreement” within the announcement.

I think some people have seen the figure of £50M being available and their eyes have lit up with dollar signs, while others hearing the word “loan” are now panicking that the club is going to be loaded down with debt.

Context is absolutely essential here to understanding how it is going to work.

The loan being made available to the club as part of this deal is not a wedge of cash just being tipped into the Blues bank account to be spent on whatever takes the fancy of the club.

Neither is it a new millstone to be hung around the club’s neck to keep us down in the financial dumps.

The loan is basically a facility to be drawn upon in increments to provide working capital for the club.

It is available for a period of two years and can be drawn off in tranches of £5M or more (unless there isn’t £5M left to borrow, in which case the tranche borrowed can be the remainder of what is left).

This loan fulfils the EFL need for two years working capital to be provably available to the club – which is a good thing from our point of view as fans.

As I understand it, it’s more tax efficient for SCL (and by extension Knighthead) to loan the club money than to put it in via any other method.

The first £5m to be drawn down from this loan will pay for the repairs to the ground.

This is really important to remember as will become apparent further down the article.

As security for the loan, SCL will hold a charge against the entire club. This is really important too, as it ensures that SCL have complete financial control of the club from the off regardless of owning only 46.4% of shares.

There is also a clause which means that the club can borrow up to £30M from BSH should there be no more money available from Knighthead.

My feeling on this is that it’s an backstop should something completely crazy happen to prevent a financial implosion, and I doubt it will be used.

The Management Agreement

As part of the deal, there is a management agreement in place for how companies within the Birmingham City plc group will be run.

The principal difference I can see is that each of the BC plc companies will have seven directors on their board.

At present, there are four people on the Birmingham City Football Club plc board (Frank Zhao Wenqing, Jerry Yiu Chun Kong, Edward Zheng Gannan and Shayne Wang Yao); two people on the Birmingham City plc board (Zhao and Yiu); and just one person on the Birmingham City Women Football Club Ltd board (Gannan).

Each board will have four people nominated by BSH and three by SCL, and the quorum for any meeting will be four directors including a minimum of one nominated by BSH.

Again, I can understand there is a bit of worry about the way the new board will be split, but I think we have to trust the lawyers on this one.

I do not for one second believe that SCL would put up a huge amount of money to do this deal only to not have control of the club.

Furthermore, it’s my understanding that the current members of the three boards won’t be on them going forwards.

One interesting thing in this announcement is that SCL have agreed that if this deal is completed by June 30, they will pay the amount that would be due to be paid by ORI under that company’s profit / loss sharing agreement with BSH.

As I expect Birmingham City plc to lose about £25M this year, that would land SCL a bill of 75% of £25M – £18.75M; a fairly hefty chunk of change in comparison to the £10M or so consideration for the stakes in the club and the stadium company.

The Debt

This is where the some of the cleverness from SCL’s lawyers really shines through as it’s here where BSH are screwed to the floor.

As part of the agreement, there is something called a “Subordination Deed”.

What this does is ranks the debts both old and new that will be owed by Birmingham City plc to BSH and to SCL and confirms in which order they will be repaid.

The deed ranks the debts so that the debt owed to SCL from the loan described above becomes the “Senior Debt” and the original debt owed to BSH becomes the “Subordinated Debt”.

The deed then contains four clauses, which boil down to essentially one thing; that while any of the “Senior Debt” is owed, none of the “Subordinated Debt” can be collected or repaid.

What that means in English is that for as long as Birmingham City plc owe money to SCL, BSH cannot take one penny out of the club as repayment of debt.

Remember when I said that the first £5M of the loan SCL has made available to the club as part of this deal is for the repairs to St Andrew’s?

This becomes an incredibly smart move, as it means that from the moment that is drawn, BSH can’t take any money out … and repairs were started yesterday.

What that also should do is reassure people that should Jude Bellingham move from Borussia Dortmund this summer, not one penny of the sell-on clause can be taken from the club by BSH.

The Next Stage

As per the announcement, a circular is being prepared to send out to BSH shareholders ahead of the EGM and is expected to be dispatched within 20 business days.

This period cannot be shortened, although should there be any hitches or legal questions it can be lengthened.

Assuming everything goes to plan, this means the circular should be dispatched on Wednesday June 7 (allowing for the public holiday in Hong Kong on May 26 for the Buddha’s Birthday).

Under rule 17.46 (2) of the Hong Kong Stock Exchange, there must be a minimum of 10 business days notice given of an EGM. This means that once the circular has been published on June 7, the earliest a meeting could be held would be June 21.

However, as Dragon Boat Festival (another HK public holiday) is June 22 it is feasible that any meeting would be held shortly after this due to the things that would need to be executed in the aftermath of the EGM.

The sooner the EGM is held, the sooner that SCL take control which means it’s in the interest of SCL to ensure BSH sort their shit out as quickly as possible.

This is why I think the lawyers have dangled the £18.75M carrot of SCL paying the profit / loss sharing agreement (as mentioned earlier in this article) if the deal is completed by June 30.

This ensures that delaying tactics or bullshit on BSH’s behalf suddenly becomes very expensive.

That carrot was also probably helpful in getting the definitive agreements and this announcement signed off prior to the end of the season, as it has maximised the amount of time for the preparation of the circular and the EGM.

Once the EGM is done, everything can move forwards.

However, until then I think we’re at the most delicate phase of the whole deal as we need it signed off by external authorities.

That means now is the time for patience rather than pressure; especially from the likes of me and other people in the media.

We’re almost at the finishing line, albeit a year after being told it was done.

With a bit of luck Jeremy Dale, Tom Wagner and co will be standing on the Kop, scarfs aloft to confirm their arrival as new custodians of the club by the end of June.

Then it’ll be time to crack open the champagne.