You can read last week’s piece at this link.

It’s very difficult to locate every business that Birmingham Sports Holdings owns. Ownership of subsidiaries can be very convoluted, for both tax and privacy reasons.

I’ve found subsidiaries of BSH owned via both British Virgin Island and Samoan companies which make it very hard to confirm details properly as it is impossible to get company information from either of those jurisdictions.

With this mind, rather than looking at individual companies, I’ve tried to examine the “segments” that BSH uses in their accounts to separate how much each bit of the group brings to the table.

As it stands, apart from Blues there are three segments to what BSH owns.

The first segment is a property company operating various commercial and residential sections of the One Park development in Phnom Penh, Cambodia.

Then there is a segment which runs a lottery software company which operates out of Beijing.

Lastly, there is a segment which runs a medical company which runs in Japan, Hong Kong and China.

One Park

While most people look to Hong Kong and China for information about who owns Blues, these days it’s actually Cambodia that should be drawing attention. When BSH sold 21.64% of the club to BVI investment vehicle Oriental Rainbow Investments, they made Chinese-Cambodian businessman Vong Pech the largest shareholder in the club itself.

Vong first got involved with BSH when the Hong Kong company did a deal to swap shares in itself for properties in the One Park development. In the end two deals have been done, which have ensured that Vong ended up with 2.9bn shares while BSH makes a guaranteed rental income from the properties.

I’ll be honest, I wanted to break down exactly what BSH own in Cambodia, but it’s difficult to understand. The best I can offer is that BSH leased a residential block of 70 apartments, a commercial building and an educational building, which they have then leased back to Ever Depot (a subsidiary of Graticity Real Estate Development, the original owners) to manage for them. I think the idea in doing so was the save themselves the faff of sorting out all the leases and instead bank a guaranteed income.

On Instagram it’s possible to watch BSH director Joe Hsiao Charng Geng talking about why he loves living in One Park – especially the flowers, the trees and the birdsong.

Regardless of how the deal worked, we can see in the last accounts BSH published the company made HK$24.8m in lease income (about £2.5M) from their investment in One Park. However, the segment lost money overall because of the pandemic; values for the properties had dropped by HK$22.4M over the year to June 30, 2020.

As of the last annual report, the One Park segment made up around 10.71% of BSH’s total revenues.

Wangmei Online

In July 2019, BSH made a voluntary announcement to the Hong Kong Stock Exchange to confirm that they were purchasing a Beijing-based lottery software company called Wangmei Online (Beijing) Information and Technology Co Ltd for RMB20M (about £2.3M) and they would stick in a further RMB6.3M (about £750,000) as equity.

The deal was another one that was designed to guarantee income – around RMB30M (about £3.5M) over three years with the seller offering to top up profits if Wangmei Online didn’t hit the set profit targets.

While this seemed an ordinary deal with an independent third party, I picked up at the time that BSH Chairman Zhao Wenqing also appeared to be a shareholder of the purchased company, making it very much not an “independent third party”.

My complaint to the HKSE took a while for them to deal with, but in November BSH confirmed in another voluntary announcement that while Zhao did indeed hold 2.2% of Wangmei Online in trust for the actual owner Gao Lei, there was a convenient reorganisation of shareholders and directors just before the deal was done which took Zhao out of the picture.

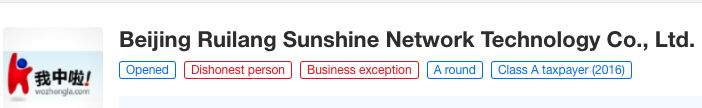

Funnily enough Gao Lei and Zhao Wenqing are both shareholders in another Beijing lottery software company, called Beijing Ruilang Sunshine Network Technology Ltd – which weirdly has a very similar logo to Wangmei Online. Zhao is also listed as a director.

That company isn’t doing so great. It has four judgements against it naming it as a “dishonest company”, while legal representative (and former Business Development Manager at BSH) Zac Karlaftis has four “high consumption” orders – the same sort as the ones found against Blues CEO Ren Xuandong’s name.

While the lottery segment was due to make profits over the next three years, a look at the 2020 accounts show that it didn’t. It brought in revenues of just over HK$2.3M (about £240K), and lost HK$8.461M (around £850K). It’ll be interesting to see if this has improved in last six months with Covid still very much a thing.

As of the last accounts, the lottery segment accounted for just 1% of the revenue generated by BSH

Medi Hub

In July 2020, BSH made a voluntary announcement to the HKSE that they had acquired two companies offering a medical service business in Japan. The business offers rich people in China another avenue for healthcare outside of the People’s Republic.

The most conspicuous thing about that announcement was the lack of details about the companies that BSH had invested in. BSH confirmed because the transaction was so small, and the company being purchased was an independent third party, that the transaction was not notifiable.

As a shareholder and a nosy git, that didn’t sit well with me and a while back I emailed BSH to ask them if they could confirm to me the name of the companies at least.

I got a very nice response from the company secretary Robert Yam, who confirmed:

The Japanese medical companies in which the Group acquired are MediHub K.K. and its affiliated company. MediHub is primarily engaged in provision of medical consultation and healthcare and wellness referral services in Japan. The founder of the company has extensive experience in this segment and has good network in medical service industry in Japan. We plan to ride on the existing platform of MediHub and expand the business through strengthening the connection to Chinese customers.

The idea of the business is an interesting one.

Back in 2017, the New York Times reported on a growing trend for Chinese people to travel abroad for healthcare. In the year prior to the report there were 500,000 outbound medical trips by Chinese citizens. While much of it was plastic surgery and routine examinations, the number of critically ill Chinese patients seeking treatment abroad was growing.

The South China Morning Post reported last July that with some medical devices and technology difficult to get hold of in mainland China, the Government there created a “special health care zone” in Hainan which would benefit from preferential policies.

Medi-hub’s website can be found at aimmeditech.co.jp, where one can see cancer clinics and other institutions that are on offer to Chinese citizens who choose to use their services.

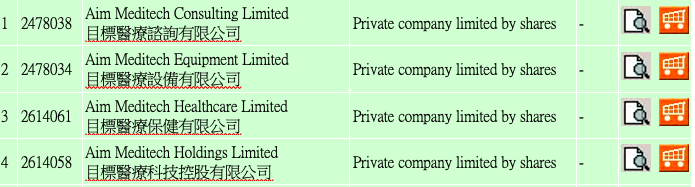

It’s been difficult to find much information on how BSH are running this business, but a search of the Hong Kong Company Registry has found four companies all using the “Aim Meditech” name of the above URL, which have Zhao Wenqing as director.

All four businesses are owned by a BVI company called Cosy Lane Ltd, which is I suspect is a subsidiary of BSH based on some of the other businesses it owns.

Interestingly, Zhao is also Legal Represenative of a Chinese business called Beijing Goal Medical Technology Co Ltd, which is listed as a company dealing in import and export along with sales of class I and class II medical devices. That business is owned by one in Hong Kong called Birmingham (Investments) China Ltd, which is also owned by the aforementioned Cosy Lane.

As it’s been less than a year since the business has been bought, we have no idea yet of what sort of revenues this company has brought into BSH. We will find out more when the accounts are due on Friday February 26.

One of the chief reasons that BCFC has not been able to be separated from the listed company has been the dependence of BSH on BCFC for revenue. As can be seen from the stuff above, BCFC made up about 88% of the revenues earned by BSH in the last accounting year.

I think that will change in the interim accounts on Friday. The sale of 21.64% of the club and 25% of the stadium will reduce the amount of revenue that BSH collects from the club; with a bit of luck the other segments will have increased revenues.

There’s other potential avenues for earning cash too.

When searching for other businesses that Zhao operated, I found an education one called Princeton Education Holdings which is owned by Cosy Lane (and presumably thus by BSH), along with a finance company called Birmingham Finance Ltd.

Birmingham Finance Limited is owned by a Samoan firm called Birmingham Finance Holdings Ltd, and according to documents found online are in the process of renewing a money lending licence which ran out on 1 Nov 2020. There is confirmation an application has been received which also shows the company shares BSH’s Vertical Square office address.

What this all means for Blues is that despite some people’s fears, it is possible the club and the listed company could be separated down the line.

With China telling companies to divest their interests in football it does seem to make sense for BSH to move Blues on at some point.

The question is where they would move it onto. Logic would dictate that Oriental Rainbow Investments would be the most likely candidate as they already have a slice of the pie.

While I’m confident the elusive Mr King controls ORI, officially that company is controlled by a Cambodian national rather than a Chinese.

It’s not hard to guess what might happen next.